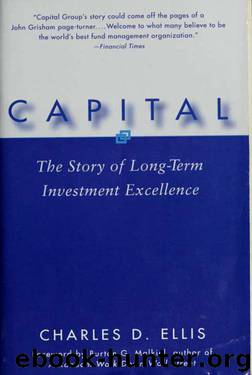

Capital : the story of long term investment excellence by Ellis Charles D

Author:Ellis, Charles D [Ellis, Charles D]

Language: eng

Format: epub

Tags: Capital Group, Capital Group Companies, Investment advisors, Investeringsbanken, Bedrijfsgeschiedenis (wetenschap)

Publisher: Hoboken, N.J. : Wiley

Published: 2004-06-30T19:00:00+00:00

The next morning, Fullerton, Kirby, and Jon Lovelace were ushered into a huge office. At one end, were three flags standing in stanchions: Los Angeles Count)^ State of Cahfornia—and the American flag. "How do you hke our American flag?" asked the country treasurer. Kirby blurted right out, "It's awful. Red, white . . . and . . . purpled

"Competitive bidding," said the treasurer, with a big grin. "Now will you guys please submit your bid?"

So Capital did submit a bid, with a fee of ^4 of 1 percent, which was far higher than any of the others. Most trustees of a public pension fiind are teachers, firefighters, and police officers, and although they are very cost conscious, they do not know the arcane ins and outs of investing, including the way fees are set. So when the question of fees came up during the final discussions about which managers to choose, the county treasurer leaned back in his chair and laconically advised the fiind trustees: "I've made a very careful examination of the fees of all the different bidders and have determined that all the fees are within just Va of 1 percent of one another. So I think, in making their decision on managers, the Trustees can safely ignore any differences in fees!"

That statement instantly neutralized what Kirby had assumed would be the decisive factor against Capital—and it won the enormous account. Actually, the account started at only $10 million, but that was $10 million of cash flow per month. And in no time, it grew to be more than $100 million. Then Oregon came in with S40 million—again at full fee^'^—and Capital was off to a strong start with the public pension fiands.

Since Capital had no institutional accounts with long-term records, Ned Bailey^^ and Jim Fullerton developed the "20-man slide

^^Five times the fee that had been paid to Scudder, Stevens & Clark, Kirby s prior employer. ^-''Ned Bailey—combining a warm, dignified demeanor "on stage" with self-disciplined organization—was a highly effective salesperson for Capital Guardian Trust. As a dutiful son, Bailey flew to Cleveland each month to visit his widowed mother, and made a practice of adding two or three days of sales calls onto the weekends so the trips would be "productive."

Download

This site does not store any files on its server. We only index and link to content provided by other sites. Please contact the content providers to delete copyright contents if any and email us, we'll remove relevant links or contents immediately.

Rich Dad Poor Dad by Robert T. Kiyosaki(6642)

Pioneering Portfolio Management by David F. Swensen(6303)

How To Win Friends and Influence People by Dale Carnegie(4515)

The Money Culture by Michael Lewis(4211)

The Dhandho Investor by Mohnish Pabrai(3771)

The Wisdom of Finance by Mihir Desai(3751)

Liar's Poker by Michael Lewis(3452)

Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets by Nassim Nicholas Taleb(3125)

The ONE Thing by Gary Keller(3074)

Mastering Bitcoin: Programming the Open Blockchain by Andreas M. Antonopoulos(3047)

The Intelligent Investor by Benjamin Graham Jason Zweig(3045)

The Psychology of Money by Morgan Housel(3039)

Rich Dad Poor Dad: What The Rich Teach Their Kids About Money - That The Poor And Middle Class Do Not! by Robert T. Kiyosaki(2961)

Investing For Dummies by Eric Tyson(2956)

How to Day Trade for a Living: Tools, Tactics, Money Management, Discipline and Trading Psychology by Andrew Aziz(2951)

How to Win Friends and Influence People by Dale Carnegie(2919)

Market Wizards by Jack D. Schwager(2702)

How to Pay Zero Taxes, 2018 by Jeff A. Schnepper(2656)

Zero Hour by Harry S. Dent Jr. & Andrew Pancholi(2652)